Potential Relief for Frontline Workers in Loan Charge Crisis

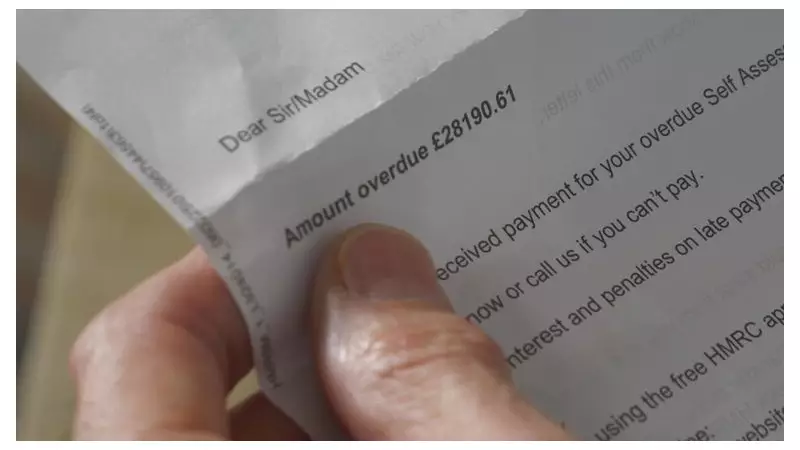

Nurses and social workers could receive exemption from a controversial tax crackdown that has devastated thousands of families and been connected to at least ten suicides across the UK. The loan charge scandal has left approximately 50,000 people facing financial ruin through massive, backdated tax bills.

The crisis stems from schemes where freelance employees were paid through "loans" via third parties that never required repayment. Unlike regular salaries, these loans weren't subject to income tax, allowing workers to take home more of their earnings while avoiding standard tax contributions.

How the Loan Schemes Operated

These arrangements, predominantly used by workers in IT, finance and contract-based industries, also affected public sector agency workers supplied through umbrella companies. Many were reportedly misled by professional accountants who promoted the schemes as legitimate while earning commission for enrolling clients.

In 2019, the Conservative government introduced legislation enabling HMRC to recover backdated income tax covering up to ten years, resulting in enormous, immediate tax demands that have driven numerous individuals to bankruptcy.

New Settlement Proposal and Political Backlash

Sky News understands that Ray McCann, the former HMRC official leading the government's review into the loan charge, has proposed a new settlement mechanism based on income levels and profession. This approach would offer the most financial relief to lower-income workers, potentially including nurses and social workers.

Conservative MP Greg Smith, chair of the loan charge All Party Parliamentary Group, condemned any selective approach as "morally reprehensible". He told Sky News that any solution must provide "proper and fair settlement for all victims, not just those Labour see as politically convenient."

Campaigners from the Loan Charge Action Group have expressed concern that the review might focus exclusively on helping lower-income public sector workers, which they describe as "discriminatory and manifestly unfair." They emphasise that victims across all professions fell prey to the same mis-selling practices.

A government spokesperson confirmed their position would be clarified by Chancellor Rachel Reeves' upcoming budget, expected later this month. Ministers have previously indicated they seek to help people unable to resolve their debts while "ensuring fairness for all taxpayers."

HMRC maintains that these disguised remuneration schemes were never legal and allowed participants to avoid approximately £20,000 of income tax per year on average. The review has faced criticism for not examining the principle of retrospective tax legislation or HMRC's conduct during the period these schemes operated.