A former circuit judge has publicly called on the government to impose a significant new tax on pointed kitchen knives in an effort to combat violent crime across the UK.

The Proposed Knife Tax

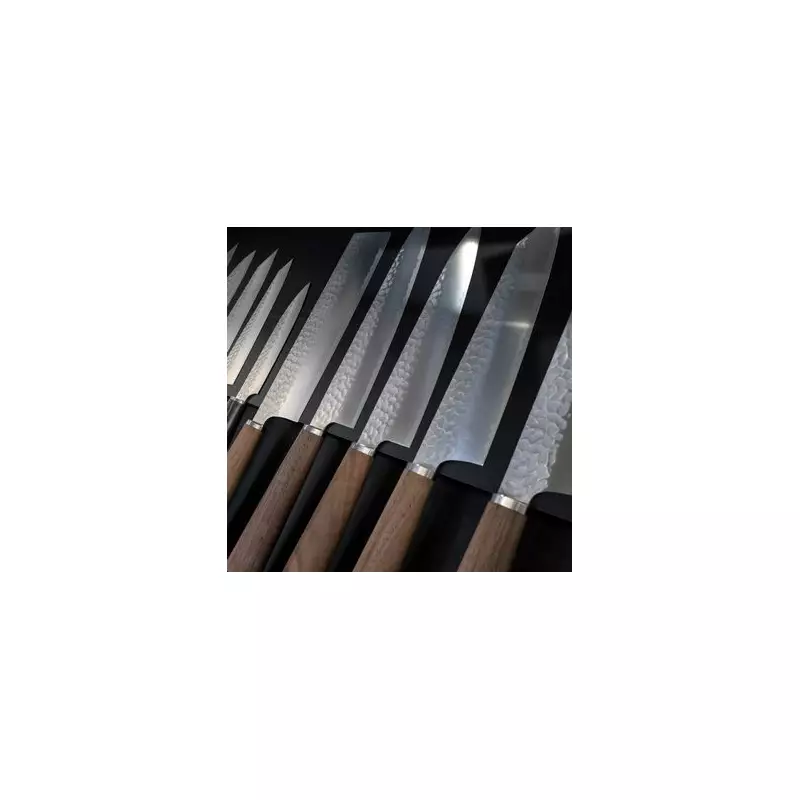

In an open letter to Chancellor Rachel Reeves, retired judge Nic Madge has proposed adding a tax of approximately £20 on every pointed kitchen knife over three inches long that is manufactured in or imported into the country. The suggestion is part of the upcoming Budget considerations.

Judge Madge, who co-founded the Safer Knives Group, argues that this financial measure would create a price differential, discouraging casual purchases while still allowing professional chefs, butchers, and fishmongers access to the tools they need. He draws a direct parallel to the success of the 5p charge on single-use plastic bags, which dramatically reduced their use.

Campaign for Safer Alternatives

The push for this legislative change is gaining momentum. Last week, Madge was joined at an anti-knife crime conference in London by Leanne Lucas, a yoga teacher who survived the Southport attack. Lucas has founded her own campaign, Let's Be Blunt, which advocates for a public shift towards round-ended knives.

This advocacy is supported by scientific research. A study conducted earlier this year by De Montfort University demonstrated a significant safety difference. Their tests showed that ten different round-edged blades failed to penetrate cotton and denim after 1,200 stabbing attempts, whereas two different pointed blades did so readily.

Rationale and Potential Impact

Madge has laid out a comprehensive case for the tax. He suggests that a £20 levy would have a minimal impact on businesses, noting that "a plate of fish and chips can cost £20 in London and it is nothing compared with the value of a life lost."

He also points to existing duties on tobacco and alcohol as a precedent for taxing products that carry a societal cost. The tax would be collected from manufacturers and importers, making it easy for HMRC to enforce and seize non-compliant goods. Madge contends that the policy would not adversely affect total knife sales and could even give British manufacturers, who already produce rounded knives, a commercial advantage.

Finally, he states that the measure would cost the government nothing and would provide a small source of revenue, while its long-term benefit would be a reduction in knife-related harm.