A senior North London councillor, whose own home is reportedly valued at over £4 million, has launched a fierce attack on the government's proposed 'mansion tax', labelling it an "absolute disgrace".

Councillor's multi-million pound home faces new levy

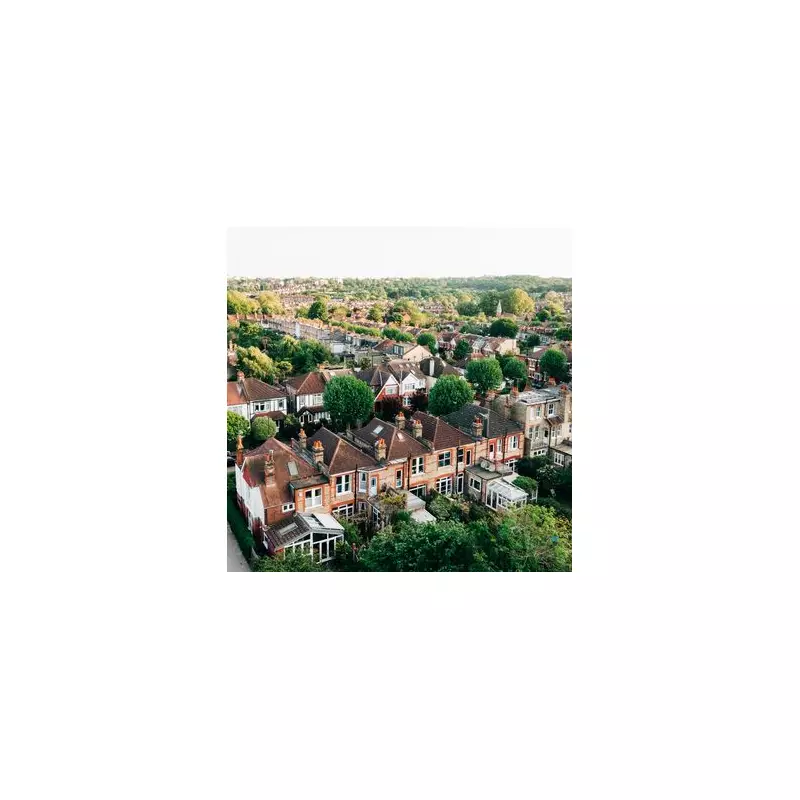

The criticism comes from Councillor Marilyn Ashton, the Deputy Leader of Harrow Council. Her property in Stanmore is said to be worth approximately £4.27 million, a figure which has soared from its 1997 purchase price. The new High Value Council Tax Surcharge, announced in Chancellor Rachel Reeves's Autumn Budget, will target properties valued above £2 million from 2028.

For Cllr Ashton, this would mean an additional annual charge of £5,000, on top of her existing council tax bill. The charge forms part of a series of tax rises and was the subject of a motion tabled by Harrow's Conservative Leader, Councillor Paul Osborn, at a Full Council meeting on 27 November 2025.

How the new property tax bands will work

The surcharge will be applied in four tiers, increasing with a property's value:

- Properties valued between £2m and £2.5m: £2,500 extra per year.

- £2.5m to £3.5m: £3,500 extra.

- £3.5m to £5m: £5,000 extra.

- Homes worth £5m or more: £7,500 extra.

Councillor Osborn argued the policy unfairly targets Londoners who have seen their homes appreciate in value. "This is not an attack on mansions, it’s an attack on people who happen to live in London whose property prices have gone up more than other parts of the country," he stated. He also expressed concern for asset-rich, cash-poor pensioners fearing they may have to sell their homes.

Political clash and claims of rule-bending

The debate ignited a sharp political row within the council chamber. The Leader of the Harrow Labour Group, Councillor David Perry, accused the Conservatives of prioritising a "non-urgent motion" about a tax due in 2028 over pressing local issues.

He also raised serious governance concerns, alleging that Conservative councillors "bent procedural rules" to allow colleagues who own £2m+ properties to debate and vote on the motion. Cllr Ashton strongly denied any wrongdoing, explaining that the council's monitoring officer had granted a dispensation because the motion covered wider budget tax increases, not just the surcharge.

"There are a number of people on the council whose house is worth over £2m and not just me," she told the Local Democracy Reporting Service.

Support schemes and industry reaction

The government has indicated that a support scheme will be established for those who cannot afford the new charge. A public consultation on the details is expected in early 2026. Options are likely to include deferring payment until the property is sold or upon the owner's death, preventing forced sales.

Analysing Cllr Ashton's situation, if she deferred payment for ten years until 2038, she would owe a lump sum of around £50,000 upon sale. The Treasury estimates the tax will affect fewer than 1% of English properties.

Reaction from experts has been mixed. Estate agent Savills called it "probably the least worst outcome for owners of prime property". However, the Institute for Fiscal Studies criticised the design, stating that while taxing high-value homes more was reasonable, "the design of this tax leaves much to be desired."