Civil Service Pension Delays Force Retirees to Seek Emergency Loans

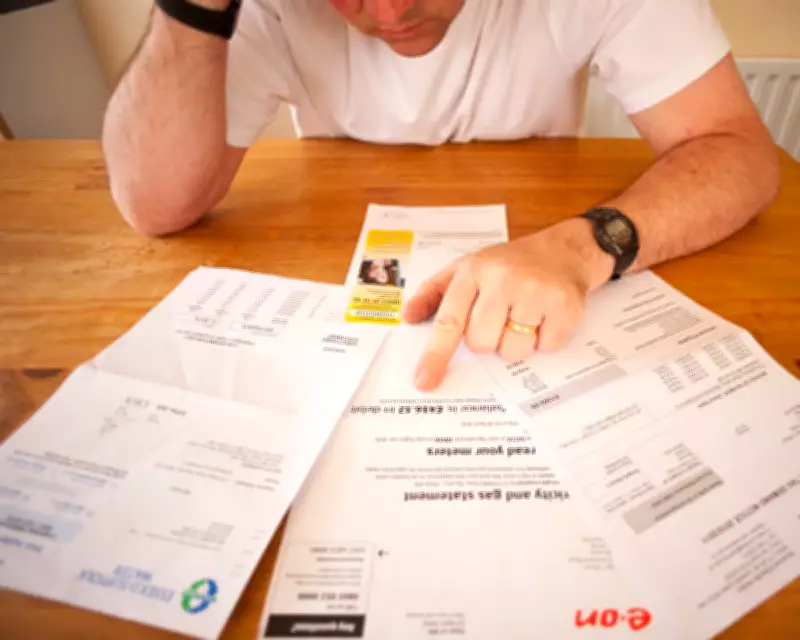

Newly retired civil servants are reporting severe financial struggles due to significant delays in receiving their pension payments, with many forced to rely on family support or emergency government loans to cover essential bills and food costs. The government has acknowledged the crisis, offering interest-free "hardship loans" of up to £10,000 to the worst-affected individuals, as a backlog of nearly 90,000 cases threatens to persist for months.

Unacceptable Delays and Financial Hardship

Nick Thomas-Symonds, a Cabinet Office minister, described the delays as "completely and utterly unacceptable" during a recent committee hearing. Approximately 3,000 civil servants retire each month, and many who left their posts since December last year have yet to receive their first pension payment. This has led to distressing situations, such as retirees applying for universal credit, depleting savings, and even requiring antidepressants due to the stress of financial insecurity.

One anonymous former civil servant, who retired from the Department for Work and Pensions in August, shared that she exhausted her savings within four months and had no family to assist her. Another retiree, who submitted her pension claim in January 2025, reported still waiting for payment, forcing her to rely on her children for food purchases and cut back on heating costs.

Backlog and Administrative Issues

The Civil Service Pension Scheme, overseen by the Cabinet Office and recently transitioned to Capita after a decade with MyCSP, is grappling with a backlog of nearly 90,000 cases, including claims, valuations, and other requests. Capita has attributed the delays to inheriting a larger-than-expected backlog from MyCSP, initially estimated at 37,000 but discovered to be 86,000 upon takeover in December. This has resulted in a surge in member queries, with many reporting difficulties logging into accounts, unanswered emails, and prolonged phone wait times.

Some retirees have faced additional challenges, such as incorrect tax codes recorded by Capita, leading to unexpected tax bills. The campaign group Civil Service Pensioners’ Alliance (CSPA) noted being "deluged" with complaints since Capita assumed administration, highlighting widespread dissatisfaction and hardship among members.

Government Response and Future Measures

In response, the government has introduced emergency loans, with standard amounts set at £5,000 and up to £10,000 for exceptional cases. Catherine Little, the chief operating officer for the civil service, indicated that around 8,500 people have experienced issues with their pension payments since December, though the exact number facing financial hardship remains unclear. The Cabinet Office has emphasised strong contractual measures to ensure Capita improves service delivery, aiming for a more reliable and efficient system for pensioners and taxpayers alike.

This situation underscores broader concerns about pension administration outsourcing, with previous reports questioning Capita’s readiness and suggesting potential in-house management alternatives to prevent future crises.