Pension Tax-Free Cash Appears Safe in Upcoming Budget

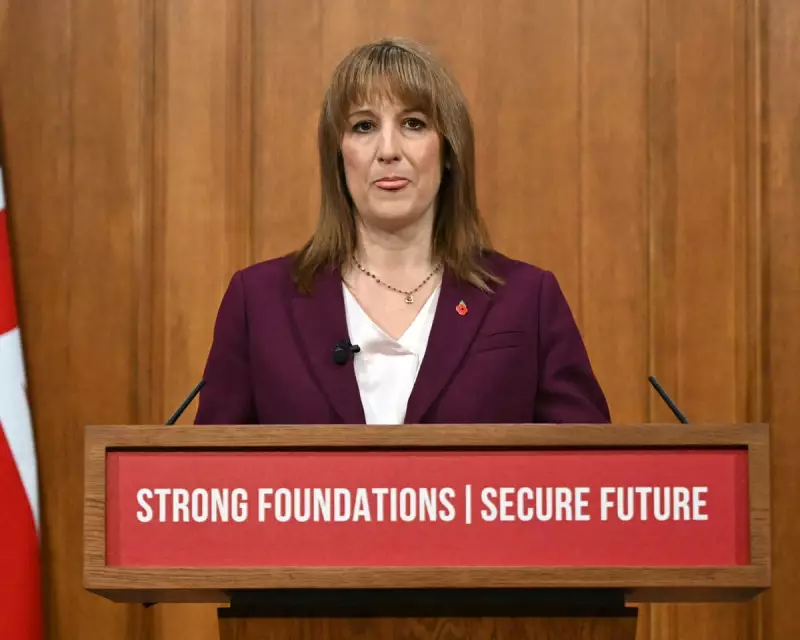

In a significant development for retirement savers across the UK, Chancellor Rachel Reeves appears to have stepped back from plans to reduce the amount of tax-free cash individuals can withdraw from their pension pots. This move will come as a major relief to millions who have been anxiously awaiting the government's budget announcements.

What is Salary Sacrifice and Why is it Under Scrutiny?

While the valuable tax-free cash entitlement seems secure for now, the Treasury's gaze has reportedly shifted towards salary sacrifice pension schemes. These arrangements have become an increasingly popular workplace perk, allowing employees to boost their retirement savings in a highly tax-efficient manner.

The mechanism is straightforward: an employee agrees to sacrifice a portion of their pre-tax salary, which is then redirected into their pension as an employer contribution. This approach offers dual benefits—it reduces both the employee's National Insurance contributions and their income tax liability. For someone earning £55,000 annually and contributing 10% (£5,500) through salary sacrifice, the current arrangement significantly enhances their take-home pay compared to conventional pension contributions.

Employers also benefit from these schemes, as they avoid paying employer NI on the sacrificed amount. Some companies even choose to reinvest part or all of this saving back into the employee's pension pot, creating a win-win situation for both parties.

The Potential £2,000 Cap and Its Consequences

The government is now considering implementing a £2,000 cap on the amount of earnings that can be exchanged for pension contributions under the NI exemption. This potential change comes amid concerns that higher earners are maximising this benefit disproportionately.

According to analysis by investment platform AJ Bell, introducing this cap could have substantial financial implications. The same £55,000 earner making a 10% contribution would see their annual take-home pay reduced by £188, while their employer would face an additional £525 in NI contributions. If salary sacrifice were removed entirely, these figures would jump to £441 and £825 respectively.

The Treasury's motivation is clear—such a move could generate up to £2 billion annually in additional revenue. However, pension experts and industry leaders have voiced strong concerns about the long-term consequences.

Amanda Blanc, chief executive of Aviva, recently told the Times: "What you're effectively doing is penalising those employers that actually contribute more to employees' pensions. But you're also saying to people who save for their pension that perhaps they shouldn't do it, and I think that's bad news long-term for the UK if you think about the fact that 15 million people in the UK are not saving enough."

The Current Pension Landscape and Future Outlook

Under existing regulations, individuals aged 55 (rising to 57 from April 2028) can typically access up to 25% of their pension as a tax-free lump sum, with a maximum limit of £268,275. The apparent decision to preserve this valuable benefit has been widely welcomed.

Helen Morrissey of Hargreaves Lansdown commented: "Restrictions to tax-free cash are reported to be firmly off the table. It's a move that will be greeted with a huge sigh of relief from people who have worked hard to build up a decent retirement income and were concerned about the looming loss of a valuable benefit."

Meanwhile, the broader question of pension tax relief—which costs the Treasury between £50 billion and £60 billion annually—appears to remain untouched for this budget cycle, though it continues to be a subject of perennial speculation.

As the budget announcement approaches, retirement savers and employers alike will be watching closely to see how the Chancellor balances revenue generation with the crucial need to maintain incentives for long-term pension planning.