Major Policy Reversal Just Weeks Before Budget

In a significant political development, Chancellor Rachel Reeves has performed a dramatic U-turn by abandoning plans to increase income tax rates ahead of the autumn budget. The reversal comes less than a fortnight before the budget scheduled for Wednesday 26 November and represents a major shift from the government's previous position.

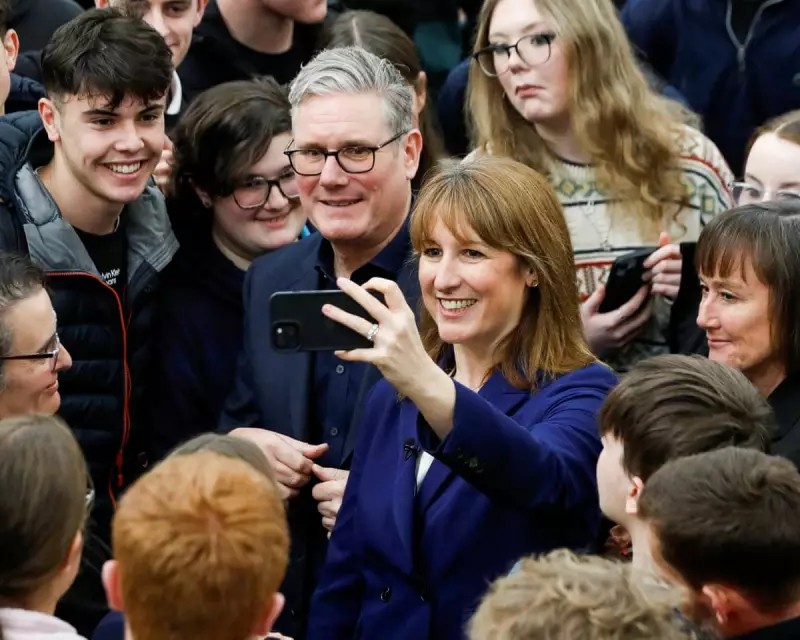

The Financial Times first broke the story on Wednesday evening, revealing that Reeves and Prime Minister Keir Starmer had decided to ditch their manifesto-busting plan to raise income tax rates. The Guardian subsequently confirmed the report, marking a stunning turnaround from the chancellor's position just days earlier.

Political Fallout and Market Reactions

The U-turn has created substantial political challenges for the government. Downing Street and the Treasury had spent weeks preparing Labour MPs for a potential breach of their manifesto commitment, emphasising the need to avoid speaking out against budget measures due to concerns about bond markets and UK borrowing costs.

This messaging now appears hollow following the chancellor's reversal, which comes amid internal party warfare and leadership challenges targeting the prime minister. The timing, just days before the budget, has raised questions about government stability and decision-making processes.

Culture Secretary Lisa Nandy, while not denying the Financial Times report, rejected suggestions that the U-turn made the government appear chaotic during an interview on Sky News. Meanwhile, Conservative leader Kemi Badenoch welcomed the news, stating on social media: "Good. (If true). Only the Conservatives have fought Labour off their tax-raising plans."

Financial Markets Respond Negatively

The policy reversal triggered immediate reactions in financial markets, with UK government borrowing costs rising significantly following the FT report. The yield on 30-year gilts increased by 12 basis points, while 20-year gilt yields reached 5.225%, also up 12 basis points.

According to Reuters, these movements put long-dated gilts on track for their worst performance since July 2, when a previous appearance by Reeves in parliament had similarly unsettled investors. BBC economics editor Faisal Islam described the situation as "Ouch", noting a considerable spike in 10-year gilt rates following the news.

Conservative Party chair Kevin Hollinrake criticised the chancellor, accusing her of "rattling the markets" through constant speculation about potential tax changes. He stated: "What Rachel Reeves fails to grasp is that this constant 'will she, won't she' briefing is rattling the markets and undermining business confidence. It's bad for growth, bad for investment and bad for jobs."

The developments come as the government prepares for the autumn budget amidst growing economic uncertainty and political pressure. The U-turn on income tax represents one of the most significant policy reversals since the government took office, with potential implications for both economic policy and political stability in the coming weeks.