In a significant intervention, the government has announced that almost a third of people affected by the controversial "loan charge" could have their tax debts completely wiped away. The move forms part of a wider package of reforms that will see most affected individuals have their bills cut by half, at a cost of £365 million to the public purse over the next five years.

Budget Brings Major Concessions

The decision was revealed in a report published alongside the recent budget, with the government stating it would go beyond the recommendations of an independent review led by former HMRC inspector Ray McCann. The core of the reform involves writing off £5,000 from every individual's bill. This measure disproportionately benefits lower earners, potentially clearing their entire liability, while those with the highest debts could still face bills in the hundreds of thousands.

The government has accepted the McCann Review's key suggestions, which include removing late payment interest penalties—estimated to account for about 25% of all liabilities. Furthermore, the policy of "stacking" several years of income into a single tax year, which pushed people into higher tax bands, will be reversed. The income under consideration will also be reduced by 10% annually to account for fees deducted by scheme operators, tapering to 5% above £50,000 and stopping entirely after £150,000.

A Scandal with a Human Cost

The loan charge policy, implemented by the Conservatives in 2019, was designed to recover tax revenue lost through disguised remuneration schemes. These schemes, often operated by unregulated umbrella companies, paid workers via loans that were never intended to be repaid, circumventing Income Tax and National Insurance.

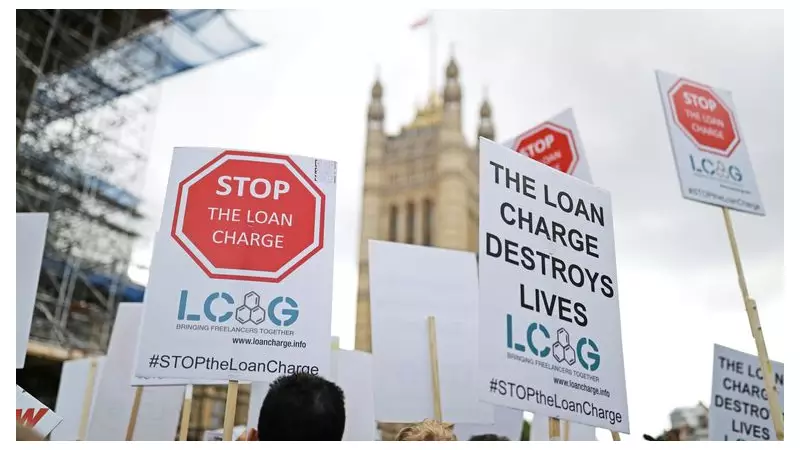

While some entered these schemes knowingly, many were agency workers, NHS staff, and contractors who were advised by accountants or given no alternative by recruitment agencies. The policy has been linked to at least 10 suicides, with HMRC made aware of a potential 11th as the review was being finalised. Campaigners have long argued it unfairly targeted the victims of mis-selling.

Campaigners Call for Fairness and Wider Scope

Despite the concessions, campaign groups have expressed dissatisfaction. Steve Packham of the Loan Charge Action Group stated the review was not a genuine examination of the scandal, noting it was led by a former HMRC official. He highlighted a fundamental unfairness: "multi-billion-pound banks" received settlements of 10-15% for using similar arrangements, while individuals are being asked to pay far more.

The review focused solely on settlement terms for those still facing the loan charge and will not re-examine the approximately 25,000 cases already closed. This has been criticised as "grossly unfair" to those who felt pressured to settle under duress from HMRC. The government, however, is proceeding with the reforms, which will be enacted through a finance bill, in an attempt to draw a line under one of the most contentious tax policies in recent years.