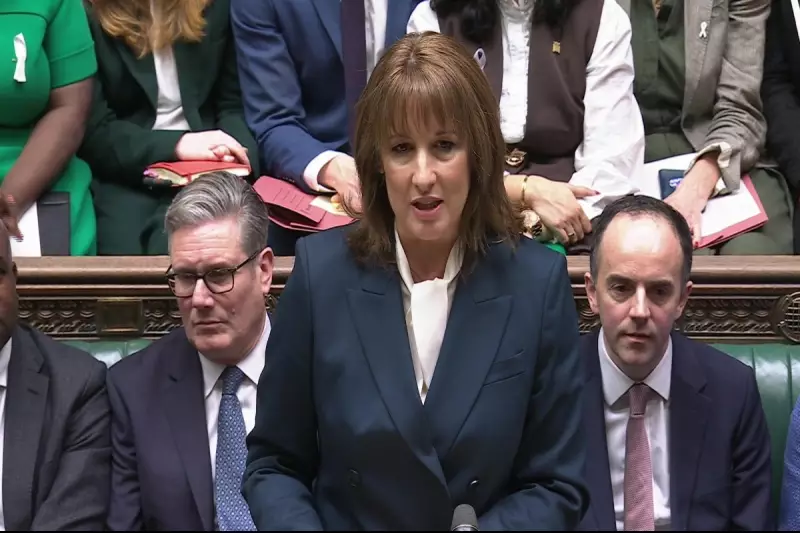

Chancellor Rachel Reeves has unveiled a substantial £12 billion increase in welfare spending, marking a significant shift in the UK's fiscal policy as the Labour government abandons key welfare reforms inherited from the Conservatives.

Welfare Spending Surge Forecast

The Office for Budget Responsibility (OBR) has projected that welfare expenditure will rise by £12 billion in the 2029-30 fiscal year compared to previous Spring Statement forecasts. This dramatic revision follows the accidental early publication of the OBR's report before the official Budget announcement.

The single largest contributor to this increase is the controversial decision to scrap the two-child benefit cap, expected to cost nearly £3 billion. Additional policy reversals account for the remaining £9 billion, including £3.9 billion from reversing Personal Independence Payment (PIP) criteria tightening, £1.7 billion from maintaining winter fuel payments, and £520 million from increasing the Universal Credit health element.

Inflation and Political Pressures

A further £3 billion annual increase stems from higher underlying inflation forecasts, which automatically triggers increased benefit payments linked to living costs. This comes as the government faces pressure from its left wing, with the two-child benefit cap removal seen as crucial to appease party rebels after earlier plans to cut £5 billion from welfare spending were defeated.

Despite the spending increases, Chancellor Reeves committed to welfare reforms, claiming Universal Credit changes would "get 15,000 people back into work." She sharply criticised the previous administration, stating: "Under the Conservatives, the cost of our welfare system increased by nearly one per cent of GDP – equivalent to £88 billion over five years."

Budget Fallout and Tax Implications

Helen Thomas of Blonde Boney described the Budget as "classic Labour" during City AM's live coverage, suggesting the Chancellor might be "saving her short-term political future" but expressing doubts about long-term success.

The welfare spending surge coincides with a £26 billion tax raid targeting landlords, savers, and bookmakers. Borrowing is also projected to be £15-20 billion higher than previously planned, influenced by welfare changes, the child benefit cap abolition, and local authority overspending.