Chancellor Rachel Reeves is expected to announce a significant tax-raising measure in today's Budget, extending the freeze on income tax thresholds for a further two years beyond 2028. This move is projected to raise approximately £8 billion for the Treasury, continuing a policy initially started by the Conservatives in 2021.

How Income Tax Thresholds Work

In England, Northern Ireland, and Wales, the amount of income tax you pay depends on your earnings, with different tax bands applying at different income levels. The system features a 'personal allowance' of £12,570, below which no income tax is levied.

For higher earners, the rules change significantly. For those with an income above £100,000, the personal allowance decreases by £1 for every £2 earned, potentially reducing it to zero. This means an individual could end up paying income tax on their entire income. It is important to note that Scotland sets its own income tax bands, so these Westminster announcements do not apply to workers there.

The Mechanics of the Freeze and Fiscal Drag

Historically, these income tax thresholds were increased annually in line with the Consumer Price Index (CPI) measure of inflation. However, since 2021, they have been frozen. While headline tax rates remain the same, this freeze has a profound effect because wages continue to rise.

This phenomenon is known as fiscal drag, a process where more people are pulled into paying tax for the first time, or into paying a higher rate of tax, simply because their rising wages push them over a static threshold. This effectively acts as a 'stealth tax', allowing the government to collect significantly more revenue without legislating for a formal tax rate increase.

The financial impact is substantial. The Office for Budget Responsibility (OBR) estimates that a continuing freeze would raise about £42.9 billion annually by the 2027/28 tax year. Similarly, the Institute for Fiscal Studies (IFS) projects that freezes to the basic and higher rates of income tax alone would raise £39 billion a year by 2029-30.

The Human Impact: Who is Affected?

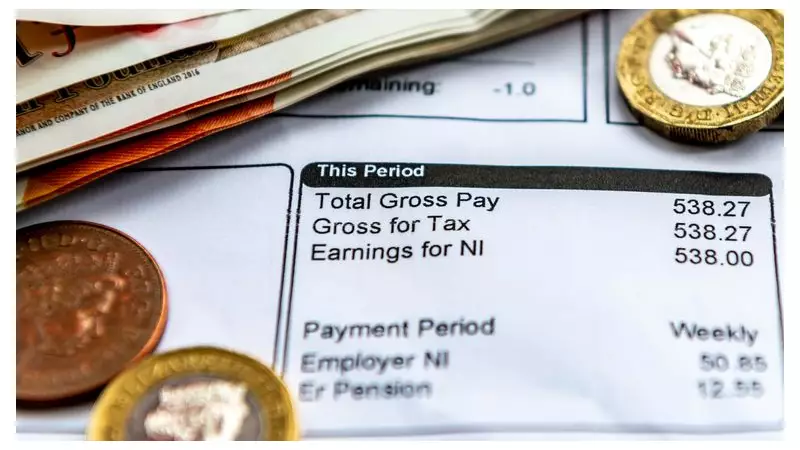

The consequences for workers are direct. An employee whose earnings merely keep pace with inflation will see a larger proportion of their salary deducted as tax due to the frozen thresholds.

The scale of this impact is vast. The OBR forecasts that by 2028-29, the freeze will bring:

- Nearly four million more people into paying income tax.

- Three million more people into the higher 40% rate.

- 400,000 more people into the additional 45% rate.

This policy represents a major shift in how the government collects revenue, with the OBR noting the effect is roughly equivalent to increasing all income tax rates by 3.5 percentage points.