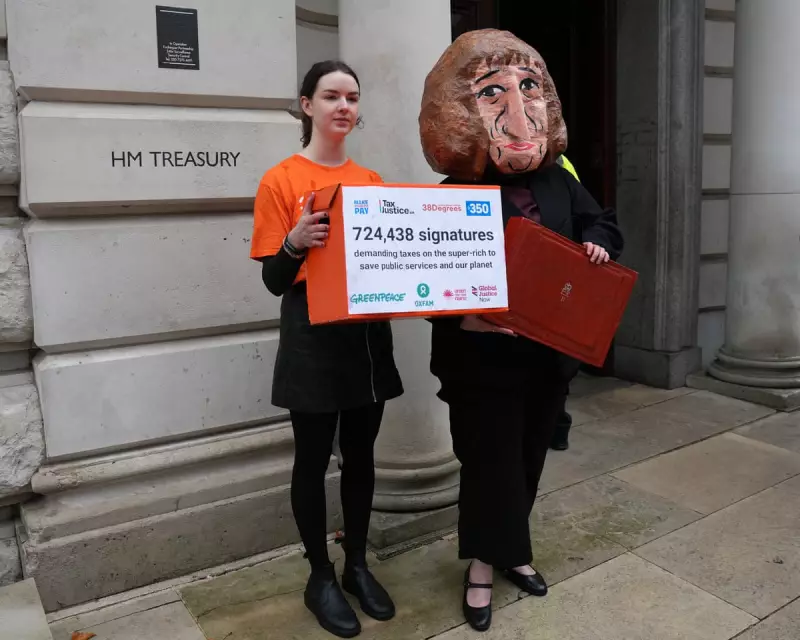

A coalition of campaign groups descended upon the Treasury on 19 November 2025, delivering a powerful petition demanding the chancellor implement taxes targeting Britain's wealthiest individuals in the upcoming budget.

The Battle Over Billionaires

Organisations including Tax Justice UK and Make Them Pay orchestrated the demonstration, calling for decisive action against the nation's growing wealth inequality. The petition arrives amidst heated debate about how to address Britain's economic divides, particularly following Guardian columnist Aditya Chakrabortty's recent critique of wealth tax proposals as "pantomime pseudo-radicalism".

Chakrabortty had argued that a 1.12% annual wealth tax on assets exceeding £10 million - estimated by the Wealth Tax Commission to raise approximately £10 billion yearly - would be "handy, but in Whitehall terms hardly life-changing".

Life-Changing Sums for Britain's Most Vulnerable

Countering this perspective, Priya Sahni-Nicholas, co-director of Equality Trust, emphasised that such amounts are far from trivial. "Earlier this year, our government was trying to push through cuts to disability benefits that would have plunged hundreds of thousands into poverty to save half that," she noted.

The argument gains particular relevance as Chancellor Rachel Reeves has indicated she cannot "leave welfare untouched" and continues exploring ways to save billions, potentially targeting society's most vulnerable. Campaigners stress that £10 billion represents life-changing money for those at the sharp end of austerity measures.

Beyond Single Solutions: A Comprehensive Approach

Wealth tax advocates clarify that annual levies on the super-rich represent just one component of a broader strategy. Groups like Tax Justice UK estimate that comprehensive new taxes on wealth and pollution could collectively raise up to £60 billion annually.

These substantial funds could facilitate significant wealth redistribution through investment in cooperatives, returning assets to public ownership, and ambitious council house building programmes. The vision extends beyond revenue generation to actively curbing the influence of what campaigners term "the billionaire class".

Statistics reveal that British billionaires' wealth has grown by an astonishing more than 1,000% since 1990, transforming wealth inequality into power inequality that many find corrosive to democratic society.

The Political Dimension of Tax Reform

Clare Burton from Shipley, West Yorkshire, highlights the political symbolism of wealth tax demands. In an era where simplistic solutions gain traction, the call for taxing extreme wealth represents a clear alternative narrative to anti-immigration rhetoric.

"The left needs an alternative and though its answer lies in long complex arguments about fiscal and macroeconomic policies, few people understand these," Burton argues. "You can't win an argument with someone who thinks 'stop the boats' will fix their life by talking about marginal propensity to consume."

The wealth tax demand serves as an accessible political statement asserting intent to reverse the upward flow of wealth in Britain's economic system.

Targeting True Extreme Wealth

Some correspondents question the focus on millionaires when Britain hosts approximately 150 billionaires and thousands possessing wealth exceeding £100 million. Shannon Ray from Totnes, Devon, suggests targeting these ultra-wealthy individuals with higher tax rates of 10% or more, arguing they "won't miss it" while generating substantially more revenue.

This perspective warns against alienating the much larger group of asset owners with more moderate wealth, suggesting that political success requires precise targeting of truly extraordinary fortunes.

As the debate intensifies, American labour economics professor Marshall Steinbaum's analysis offers a compelling vision: his estimates suggest that a 2% wealth tax combined with inheritance taxes could reverse extreme wealth concentration within 20-30 years in the United States, providing a potential blueprint for British policy makers.

With the petition now delivered to Treasury officials, all eyes turn to the chancellor's upcoming budget decisions that will reveal whether the government intends to heed campaigners' calls for structural change through wealth taxation.