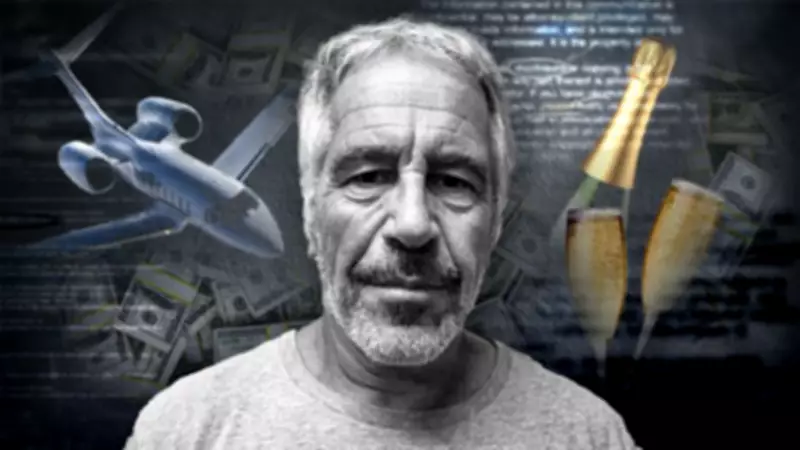

The Epstein Fortune: Unravelling the Wealth of a Paedophile Financier

The story of Jeffrey Epstein is one of power, influence, and immense wealth, all of which facilitated his heinous crimes. As the fallout from his death continues, questions linger over how this convicted paedophile built a fortune that enabled his illicit activities. This explainer delves into the origins and mechanisms of Epstein's financial empire, shedding light on the murky world that allowed him to operate with impunity.

The Scale of Epstein's Wealth

A document signed by Epstein just two days before his suicide in 2019 revealed his estate was valued at approximately $580 million, equivalent to £475 million at the time. This staggering sum was managed through the 1953 Trust, a vehicle designed to conceal the identities of his beneficiaries. Recently released by the US Department of Justice, the trust indicated that over 40 individuals, including Ghislaine Maxwell, were set to inherit millions each.

Epstein's assets once included the largest residential property in Manhattan, two private islands, and three aircraft. However, the legitimacy of these holdings remains under scrutiny, with suspicions that blackmail and covert operations played a role in their accumulation.

Early Career and Financial Beginnings

Born in New York, Epstein was considered a maths prodigy but never completed his university education. He began his career teaching at a private school for New York's elite, where he caught the attention of Alan "Ace" Greenberg, the future CEO of Bear Stearns. This connection led to Epstein's first major break in finance, where he worked his way up over five years before leaving in 1981 due to a trading violation.

Despite this setback, Epstein's earnings at Bear Stearns were substantial, with total compensation reportedly exceeding $200,000 annually. This foundation set the stage for his subsequent ventures, though his departure did not sever ties with the bank that would later collapse in the 2008 financial crisis.

Building an Opaque Financial Empire

From 1981 onwards, Epstein's business interests became increasingly shrouded in secrecy. He founded J Epstein & Company in 1988, which later evolved into the Financial Trust Company after relocating to the US Virgin Islands, a known tax haven. This move allowed Epstein to operate with minimal transparency, evading regulations that typically govern financial advisers and consultants.

His revenue streams were largely tax-free, with Forbes estimating that he saved around $300 million in taxes due to the Virgin Islands jurisdiction. Key clients included billionaire Les Wexner, who paid Epstein $200 million until their split in 2007, and Leon Black of Apollo Global Management, who contributed $170 million between 2012 and 2017.

Controversies and Financial Setbacks

Epstein's financial dealings were not without controversy. US prosecutors have suggested that Wexner received a $100 million repayment from Epstein in 2008, related to allegations of stolen funds and improper property transactions. Additionally, the 2008 financial crisis hit Epstein hard, with his Financial Trust Company recording net losses of $166 million between 2008 and 2010, prompting the creation of Southern Trust Company as a new income source.

Further investigations by the International Consortium of Investigative Journalists revealed that Epstein's wealth was often cloaked through offshore shell companies, adding to the opacity of his operations.

Legitimacy and Sinister Undercurrents

While Epstein's financial activities may have been legal on the surface, there is growing evidence that they served as a facade for more sinister elements. Released Department of Justice files hint at the possibility of blackmail, with wealthy individuals potentially being coerced through covert filming at Epstein's properties. This theory gains traction as journalists sift through vast document dumps, though it is important to note that the identified business relationships do not imply wrongdoing by those involved.

Epstein's connections extended to major financial institutions, with JPMorgan flagging over $1 billion in suspicious transactions linked to him posthumously, some of which may have facilitated sex trafficking.

The Lasting Mystery of Epstein's True Wealth

Financial journalists continue to probe the depths of Epstein's fortune, uncovering a narrative of manipulation and secrecy. His ability to navigate regulatory loopholes and cultivate high-profile clients underscores the complexities of his empire. As legal costs and victim settlements deplete his estate, it is likely that more hidden assets will emerge, revealing the full extent of a wealth built on deception and crime.