Global stock markets have been thrown into turmoil following a fresh tariff threat from former US President Donald Trump, sending the UK's leading share index into the red and forcing the Chancellor to cancel a high-profile City event.

Markets Slide as Tariff Threat Looms

The FTSE 100 fell 0.4% as trading began on Monday, mirroring sharp overnight declines across Asia. The sell-off was triggered by Trump's announcement on Saturday that he would impose tariffs on eight European nations, including the UK, Germany, and France. He threatened an initial 10% levy from 1 February, escalating to 25% on 1 June, unless the United States is permitted to purchase Greenland.

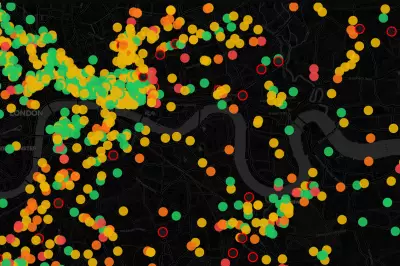

Investors rushed to safe-haven assets like gold and silver, spooked by the prospect of renewed trade wars. The contagion spread across European bourses, with France's CAC 40 down 1.6%, Germany's DAX falling 1.4%, and Spain's Ibex 35 dropping nearly 1% in early trading.

Chancellor Reeves Withdraws from LSE Celebration

The political and economic shockwaves forced Chancellor Rachel Reeves to abruptly pull out of a planned appearance at the London Stock Exchange. The event was intended to celebrate a "new golden age" for the City following the FTSE 100's recent breach of the 10,000-point milestone.

The Treasury confirmed her withdrawal. Instead, Reeves is expected to attend a press conference with Prime Minister Sir Keir Starmer at Downing Street to discuss the impending US tariffs. The LSE event proceeded without her, fronted by chief executive Julia Hoggett, as ticker tape showered the trading floor at the market open.

Analysts Warn of Economic Damage

Financial analysts expressed deep concern over the potential impact. Deutsche Bank noted that while tariffs announced on previous occasions were later softened, the current threats are real. "As it stands the tariff threats are real, and would be economically and geopolitically damaging," they stated.

The immediate market reaction underscores the fragility of global trade relations. With US markets closed on Monday for Martin Luther King Jr. Day, European investors were left to gauge the initial fallout alone, resulting in a uniformly negative opening session.