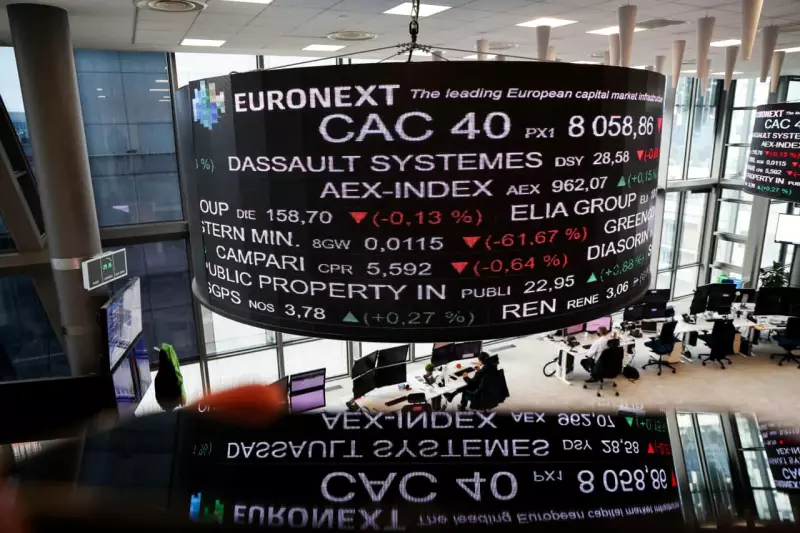

European exchange operator Euronext has delivered another impressive financial performance, marking its sixth consecutive quarter of double-digit revenue growth as ongoing market volatility continues to fuel trading activity across its platforms.

Sustained Growth Amid Market Turbulence

The pan-European market infrastructure reported revenue growth of 11.4% year-on-year for the first quarter, demonstrating remarkable resilience in challenging market conditions. This consistent performance underscores Euronext's strategic positioning within Europe's financial ecosystem.

Chief Executive Stéphane Boujnah highlighted that the strong results were primarily driven by sustained volatility across fixed income and equity markets, creating favourable conditions for trading activity. The exchange operator has successfully capitalised on these market dynamics while continuing to expand its service offerings.

Detailed Financial Performance

Euronext's trading business emerged as the standout performer, with revenue increasing by 18.5% compared to the same period last year. This substantial growth was largely attributed to heightened activity in both cash equities and derivatives markets.

The company's fixed income trading division delivered particularly strong results, benefiting from central bank policy uncertainty and shifting interest rate expectations. Meanwhile, equity trading volumes remained robust as investors continued to reposition portfolios in response to economic data and corporate earnings.

Beyond its core trading operations, Euronext's non-volume related revenue grew by 7.6%, indicating successful diversification beyond market-sensitive income streams. This balanced growth approach has provided stability during periods of fluctuating trading volumes.

Strategic Developments and Future Outlook

Euronext's consistent performance comes amid significant strategic developments, including the ongoing integration of recent acquisitions and technological enhancements across its trading platforms. The exchange operator has been actively expanding its footprint beyond traditional trading services.

Looking ahead, management remains cautiously optimistic about maintaining momentum, though they acknowledge that market conditions remain unpredictable. The company's diversified business model positions it well to navigate potential headwinds while capitalising on emerging opportunities in European capital markets.

Industry analysts suggest that Euronext's ability to deliver six consecutive quarters of double-digit growth in the current economic climate demonstrates effective management execution and strategic clarity. The performance sets a positive tone for the remainder of the financial year.