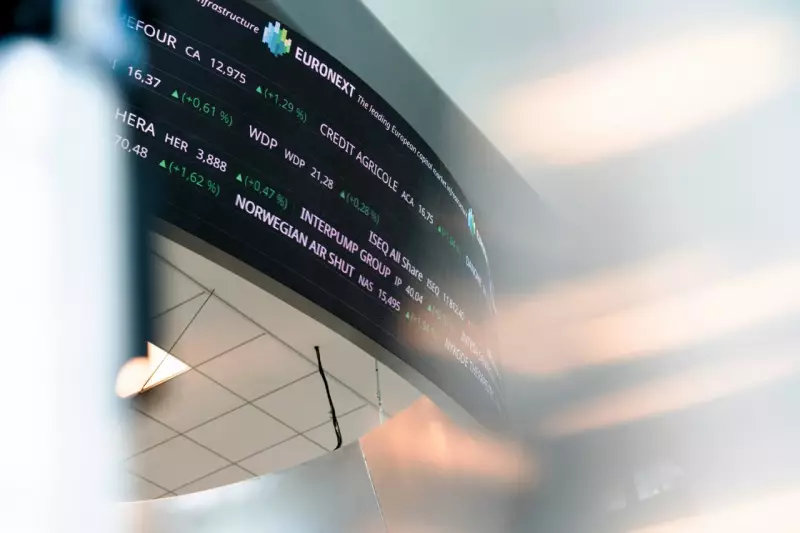

Pan-European exchange operator Euronext has successfully completed its acquisition of the Athens Stock Exchange, marking another significant step in its expansion across European financial markets. The €48.5 million deal solidifies Euronext's presence in Greece and represents its seventh major European market acquisition.

The Acquisition Details

Euronext paid approximately €48.5 million to secure a majority stake in Hellenic Exchanges, the parent company of the Athens Stock Exchange. This strategic move follows Euronext's established pattern of expanding its European footprint through carefully selected acquisitions.

The transaction involved purchasing shares from both the Hellenic Corporation of Assets and Participations and local investors, demonstrating broad support for the deal within Greece's financial community. This acquisition represents Euronext's continued commitment to creating a unified pan-European capital market.

Strategic Implications for European Markets

This acquisition significantly strengthens Euronext's position as Europe's leading exchange operator. The addition of the Greek market provides access to new listing opportunities and trading volumes, while offering Greek companies improved visibility within European financial networks.

The timing of this acquisition coincides with increasing competition among European exchange operators seeking to consolidate their market positions. Euronext's expansion into Greece follows previous successful integrations of exchanges in Dublin, Oslo, and Milan, demonstrating the company's effective cross-border operational strategy.

Future Outlook and Market Impact

Market analysts anticipate that this acquisition will bring several benefits to both Greek companies and international investors. The integration is expected to enhance liquidity for Greek securities while providing local market participants with access to Euronext's sophisticated trading infrastructure and technology.

The deal also signals continued confidence in the Greek economic recovery and represents a vote of confidence in the country's financial markets following years of economic challenges. Greek companies seeking international exposure may find new opportunities through Euronext's extensive European network.

Looking forward, industry observers will be watching how Euronext integrates the Athens Exchange into its existing operations and whether this move prompts further consolidation among European exchange operators. The successful completion of this acquisition reinforces Euronext's strategy of building a diversified pan-European market infrastructure.