Companies in the UK celebrated for their high Environmental, Social, and Governance (ESG) ratings have dramatically underperformed the broader market, according to a damning new report.

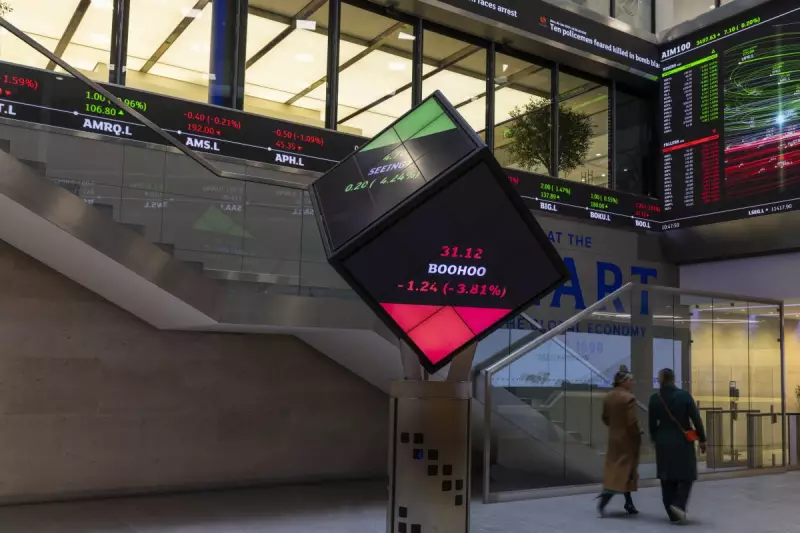

Research from the right-leaning think tank Policy Exchange reveals that 29 UK-backed firms featured in S&P Global’s Sustainability Yearbook 2023 fell by twice as much as the FTSE 100 throughout the 2024 financial year.

The High Cost of ESG Compliance

The report argues that the substantial costs associated with managing ESG rankings are a significant burden, particularly during a period of low growth for the UK economy. For a typical FTSE company, these expenses can reach an estimated £3 million per year, a figure cited by one executive.

This financial pressure is reportedly pushing some firms away from public markets and into the arms of private equity. The burden is not shared equally, with smaller businesses being disproportionately affected. The report highlights that one provider, B Lab, can charge up to £30,000 for a listing, while a fund manager claimed a mid-sized company was paying £1 million for ESG data.

Broader Market Trends and Political Fallout

The underperformance is not an isolated incident. Policy Exchange's analysis points to a longer-term trend, noting a performance gap between the MSCI World ESG Leaders Index and the MSCI World Index stretching from 2009 to 2024.

Ironically, as companies struggle with the costs, the global ESG data provider market has quadrupled in size to a staggering £1.5 billion. The report also contends that the exclusion of defence manufacturers by some ESG raters could be damaging the UK's strategic capabilities, including its ability to support allies like Ukraine.

These findings directly challenge the common narrative that strong ESG credentials lead to superior financial returns and lower risk, a view previously promoted by major firms like EY.

A Call for an Honest Conversation

The report has ignited a political firestorm. The Conservative Party has pledged to overhaul what it calls "ridiculous" ESG reporting requirements if it returns to government.

Report author Ross Clark identified a "fundamental weakness" in the ESG framework, arguing it conflates charitable activities with core governance risks and fixates on climate change while ignoring more immediate threats like poor business models.

In a foreword, equality and human rights commissioner Baroness Cash stated the paper unveils a "reluctance by business leaders to speak openly about their concerns." She called for an honest conversation about ESG's role in the UK's stagnant growth and productivity struggles, deeming such a discussion vital for the country's economic future.