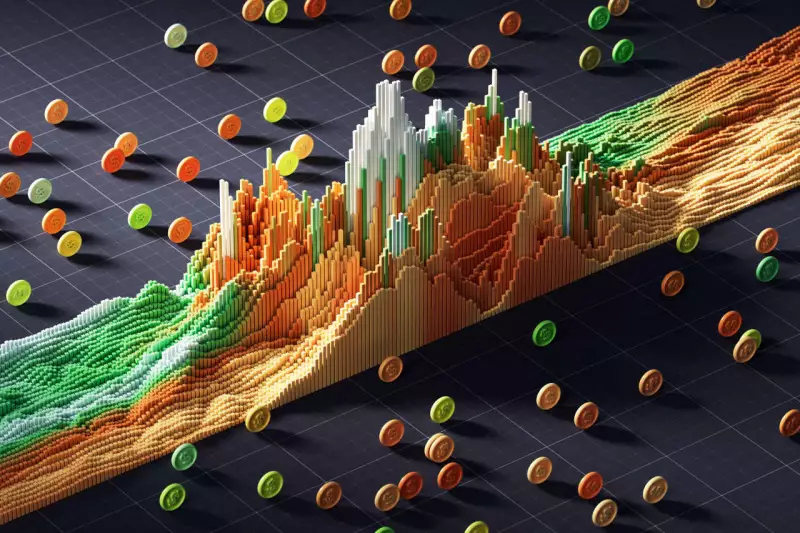

While artificial intelligence continues its relentless march into financial services, a crucial question remains: can machines ever truly replace the human touch in wealth management? The answer, according to industry experts, is a resounding no.

The Emotional Intelligence Gap

AI systems excel at processing vast datasets, identifying patterns, and executing trades at lightning speed. However, they stumble when faced with the complex emotional landscape of client relationships. "The most valuable financial conversations often happen during moments of high stress or emotional turmoil," explains a senior wealth manager from a leading London firm.

Human advisors possess the unique ability to read between the lines, detect unspoken concerns, and provide reassurance during market volatility. This emotional intelligence forms the bedrock of trust that keeps clients engaged through both bull and bear markets.

Beyond Algorithmic Thinking

Wealth management isn't just about numbers—it's about understanding life goals, family dynamics, and personal values. Human advisors bring context to financial decisions that algorithms simply cannot comprehend.

- Life transitions: Navigating inheritance, divorce, or career changes requires nuanced understanding

- Behavioural coaching: Preventing clients from making emotional investment mistakes

- Personalised strategies: Tailoring approaches to individual risk tolerance and life stages

The Hybrid Future

The most successful wealth management firms are embracing a collaborative approach where AI handles data analysis and routine tasks, freeing human advisors to focus on relationship-building and strategic guidance.

This partnership allows advisors to leverage AI's computational power while maintaining the human connection that clients value. The result? More efficient operations combined with the personalised service that builds lasting client loyalty.

The Unreplicable Human Element

From reading body language during meetings to understanding the significance of a client's business legacy, human advisors bring irreplaceable qualities to the table. While AI can suggest optimal portfolio allocations, it cannot share in the joy of a client achieving their lifelong dreams or provide comfort during financial setbacks.

The future of wealth management lies not in choosing between human and artificial intelligence, but in harnessing the unique strengths of both to deliver superior client outcomes.