Advanced Micro Devices (AMD) has delivered another impressive quarter of rapid expansion, surpassing Wall Street expectations with robust revenue and earnings figures. However, the company's share price experienced a notable decline as the market carefully assessed these results within the broader context of an industry still overwhelmingly led by chip titan Nvidia.

Strong Financial Performance Meets Cautious Market Reaction

The semiconductor firm announced fourth-quarter revenue of $10.27 billion (£7.49 billion), representing a substantial 34 per cent increase compared to the same period last year. Adjusted earnings per share also saw significant growth, rising by 40 per cent to reach $1.53.

Breaking down the revenue streams reveals where AMD's strength lies. Data centre revenue surged by 39 per cent to $5.38 billion, primarily driven by escalating demand for artificial intelligence accelerators. Meanwhile, PC and notebook sales demonstrated healthy growth of 34 per cent, and gaming revenue jumped by an impressive 50 per cent.

Despite these strong headline numbers, investor reaction remained cautious, with shares sliding during after-hours trading. The stock continued to face pressure in early European trading sessions, highlighting how closely AMD's performance is benchmarked against its primary competitor in the advanced chip market.

The Nvidia Comparison and Strategic Diversification

AMD firmly occupies the position of clear number two in advanced semiconductors, but the considerable gap to the market leader continues to shape investor expectations and perceptions. Industry analyst Gadjo Sevilla from Emarketer noted that while AMD is "growing faster and is financially healthier than Intel", it still lacks "Nvidia's sheer scale and AI dominance".

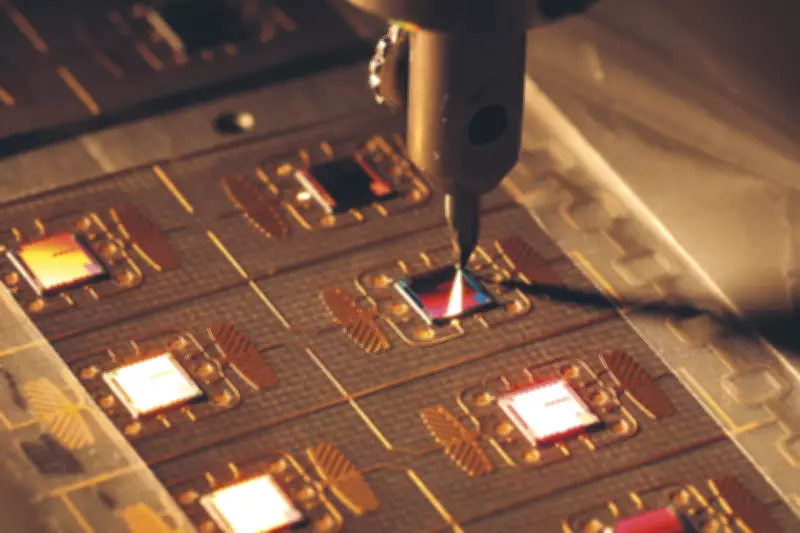

Earlier this year at the Consumer Electronics Show (CES), AMD outlined its next phase of expansion, previewing a new AI platform and launching an updated graphics processing unit (GPU). This strategic approach reflects the company's push to broaden its offerings beyond a single product line, a key point of differentiation from both Nvidia and Intel.

Ben Barringer, head of technology research at Quilter Cheviot, commented: "AMD delivered a good set of results, with revenues up 36 per cent, but it has been punished for not knocking it out of the park." He added that "AMD has taken further share from Intel, particularly in the PC and data centre markets", highlighting the company's competitive gains.

Future Prospects and Geopolitical Challenges

Looking ahead, Barringer suggested that AMD's next-generation chips, scheduled for release later this year, could strengthen its position as a secondary source for AI hardware. While challenging Nvidia directly remains "easier said than done", he believes the company "could easily become a second source for chips" in this rapidly expanding market.

However, geopolitical factors continue to present significant headwinds. Chief executive Lisa Su has indicated that AMD expects no additional revenue from China beyond the $100 million anticipated in the first quarter, citing ongoing uncertainty surrounding US export licences for advanced chips.

Recent sales to the region were linked to previously approved licences and should not be interpreted as renewed momentum in this important market. This cautious outlook has influenced the company's guidance, with AMD forecasting first-quarter revenue between $9.5 billion and $10.1 billion. While this range comfortably exceeds analysts' average expectations, it falls slightly below the most optimistic market projections.

The semiconductor landscape continues to evolve rapidly, with AMD positioning itself as a formidable challenger through strategic diversification and technological innovation, even as it navigates complex market dynamics and regulatory environments.