Abu Dhabi is dramatically transforming its economic identity from an oil-dependent emirate into a powerhouse of global finance, with Abu Dhabi Finance Week (ADFW) serving as the flagship event showcasing this remarkable evolution.

From Oil Wealth to Financial Powerhouse

The United Arab Emirates capital has strategically repositioned itself as an emerging financial nexus, with its annual gathering of industry leaders becoming emblematic of this shift. Under the theme 'Engineering the Capital Network', ADFW 2025 aims not merely to attract investment but to actively mould the future architecture of international finance.

The extraordinary growth of Abu Dhabi Global Market (ADGM), the emirate's financial free zone, underscores this transformation. By the close of 2023, operational entities within the jurisdiction had surged to 1,825, representing a substantial 32% increase compared to the previous year. Simultaneously, assets under management climbed by an impressive 35%, cementing Abu Dhabi's status as a compelling destination for fund managers worldwide.

The Engine Behind Abu Dhabi's Financial Ascent

This financial trajectory aligns perfectly with the UAE's comprehensive economic diversification strategy. Abu Dhabi is systematically reducing its historical reliance on hydrocarbons by expanding key sectors including finance, technology, and sustainable industries. ADGM stands as the cornerstone of this ambitious plan.

The economic impact extends well beyond mere statistics. The expanding financial sector now sustains a significant workforce, with registered companies continuing their upward trend. Major global institutions have established substantial operations within the jurisdiction, including:

- Goldman Sachs

- Blackstone

- Brevan Howard

- Apollo

- Tikehau Capital

According to ADGM figures, the workforce has expanded to encompass over 36,000 individuals during the first half of 2025. This growth stems from a combination of new employment opportunities, a tax-efficient environment, and a predictable regulatory framework that enhances Abu Dhabi's appeal as a business destination.

What Distinguishes ADGM in the Competitive Landscape

For international institutions considering regional expansion, ADGM's independent regulatory model presents a compelling advantage. Operating as the Middle East's sole financial centre that directly applies English common law, it provides investors and financial firms with a familiar, internationally recognised legal structure.

ADGM has demonstrated particular foresight in emerging financial domains that many jurisdictions are still grappling with. The centre has placed significant emphasis on:

- Digital assets and fintech

- Tokenisation and blockchain applications

- Sustainability-linked finance

This forward-thinking approach reflects a broader strategy to capture emerging segments of global financial activity. Geographically and politically, Abu Dhabi is establishing itself as a crucial intermediary between Eastern and Western markets. With substantial sovereign wealth assets and large-scale infrastructure, the emirate seeks to play an increasingly active role in connecting global capital flows.

ADFW: The Global Platform for Financial Ambition

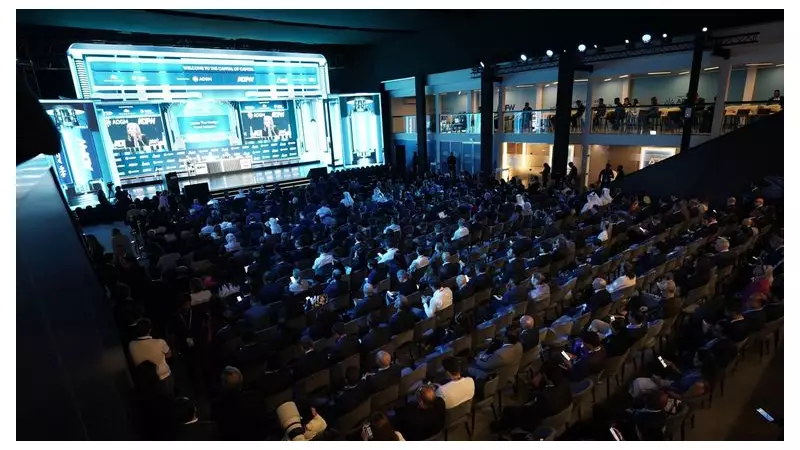

Abu Dhabi Finance Week has emerged as the most visible manifestation of these ambitions. The 2024 edition attracted more than 20,000 participants representing institutions overseeing approximately £32.3 trillion in assets. The four-day programme featured an extensive lineup including:

- Over 600 senior speakers

- More than 350 themed sessions

- Upwards of 60 events spanning multiple financial sectors

Under the theme "Welcome to the Capital of Capital", discussions explored economic, technological, human, and sustainable forms of capital. The programme incorporated several major forums including the Abu Dhabi Economic Forum, Asset Abu Dhabi, the Spear's Private Wealth Summit, and the Abu Dhabi Sustainable Finance Forum.

The 2023 edition had already signalled growing international attention, with more than 18,000 attendees from over 100 countries participating in 46 events, 180 sessions, and 300 speaker engagements. That year, fourteen major financial institutions collectively managing £343 billion in assets announced plans to establish a presence in ADGM, indicating rising confidence among global investors in Abu Dhabi's regulatory environment and long-term economic direction.

The Future: Building Tomorrow's Financial Architecture

ADGM's stated ambition positions it among the world's top-five international financial centres, alongside established hubs like New York, London, and Singapore. Its strategy concentrates on building robust networks, supporting innovation, and contributing to the broader evolution of global financial architecture.

Abu Dhabi officials have articulated a vision where the emirate plays a more proactive role in shaping finance's future, stating: "We are building the global architecture for the next generation of finance." In an environment characterised by geopolitical uncertainty, shifting supply chains, and rapid technological change, many investors prioritise stability coupled with innovation. Abu Dhabi and ADGM have demonstrated their capacity to deliver both.

As ADFW 2025 approaches, the emirate continues to position itself as a pivotal force in reshaping the global financial landscape, proving that its transformation from oil capital to capital of capital is well underway.