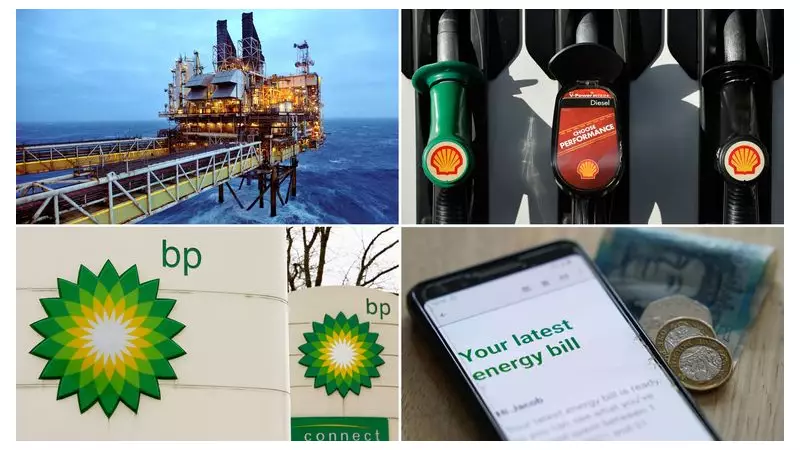

Energy Minister: 'No Shortcut' to Lower Bills as Price Cap Rises

Households across the UK face a continued wait for significant reductions in their energy costs, with the Energy Minister confirming there is 'no shortcut' to bringing down bills. This sobering assessment from Michael Shanks comes alongside the announcement from regulator Ofgem that the average annual energy bill will actually increase slightly in the new year.

January Price Cap Defies Predictions

Contrary to forecasts from analysts Cornwall Insight, which predicted a 1% drop, Ofgem has confirmed the energy price cap will rise by 0.2% in January 2025. This means the typical annual dual fuel bill will edge up from £1,755 to £1,758 for the period between January and March. This minor increase occurs despite a notable fall in wholesale energy costs, highlighting the complex factors influencing consumer bills.

The situation places further pressure on the government, which has so far been unable to deliver on its election pledge to cut bills by £300 through a transition to clean power. Chancellor Rachel Reeves is now reportedly exploring measures to ease the burden on households in the upcoming budget.

The Green Transition's Cost to Consumers

The UK finds itself in a paradoxical position. While renewable sources provided more than 50% of the nation's electricity last year, it also suffers from the second-highest domestic electricity prices in the developed world. The government's ambitious goal of a clean power grid by 2030 is now facing scrutiny as evidence grows that this pursuit is contributing to higher bills in the short term.

Minister Shanks defended the strategy, stating, 'The truth is, we do have to build that infrastructure in order to remove the volatility of fossil fuels from people's bills.' He acknowledged the challenge, adding, 'We obviously hope that will happen as quickly as possible, but there's no shortcut to this.'

Key factors inflating bills include the sharply rising cost of subsidising offshore wind, building and managing the national grid. In response, the government has increased the maximum price it will pay for offshore wind by over 10% in its latest renewables auction and extended price guarantees from 15 to 20 years. These costs, along with network charges, now constitute more than a third of an average energy bill and are set to grow further.

Gas Dependency and Political Divisions

Despite the push for renewables, gas remains central to the UK's energy security. Around 50 active gas-fired power stations underpin the grid, essential for times when renewable generation is intermittent. Michael Lewis, CEO of Uniper which runs the Connah's Quay power station in North Wales, explained the necessity of maintaining this backup, noting that these plants must be paid for even when not in constant use.

Mr Lewis suggested a short-term measure: 'If we remove those [policy costs] from energy bills and put them into general taxation, that will have a big dampening effect on energy prices.' This is one option the Chancellor is believed to be considering, alongside potential VAT cuts.

The persistently high cost of energy has fractured the political consensus on net zero. The Conservative party, under Kemi Badenoch, has reversed previous policies, with shadow energy secretary Claire Coutinho arguing that net zero is 'making people poorer.' Meanwhile, Reform UK has made opposition to net zero a central theme, with deputy leader Richard Tice calling renewables a 'catastrophe' and blaming them for the UK's high electricity prices.

As the debate intensifies, households are left navigating an energy landscape where bills remain around 35% higher than before the war in Ukraine, with the promise of long-term savings from renewables still on the distant horizon.