Homeowners in London are now the most likely in England and Wales to sell their property for less than they originally paid, according to a stark new analysis. This marks a significant shift in the UK's property landscape, with the capital overtaking the North East for the first time in nearly a decade.

The Capital's Loss-Making Trend

Data from estate agency Hamptons reveals that in 2025, nearly 15 per cent of London sellers completed their sale at a loss. This figure is substantially higher than the national average of 8.7 per cent and has dethroned the North East, which had held the top spot for nine years. In the North East, the proportion of loss-making sales fell to 13.9 per cent, a dramatic improvement from 29.9 per cent in 2019.

This reversal of fortunes coincides with diverging price trends. Halifax data shows London house prices fell by 1.3 per cent over 2025, bringing the average to £539,086. Meanwhile, the North East saw the highest annual growth rate in the country, with average prices rising to £181,798.

Flats and Boroughs Bearing the Brunt

The downturn in London is being driven overwhelmingly by the flat market. Although flats made up 60 per cent of sales in the capital last year, they accounted for a staggering 90 per cent of all homes sold at a loss. This is a sharp increase from 78.4 per cent in 2019.

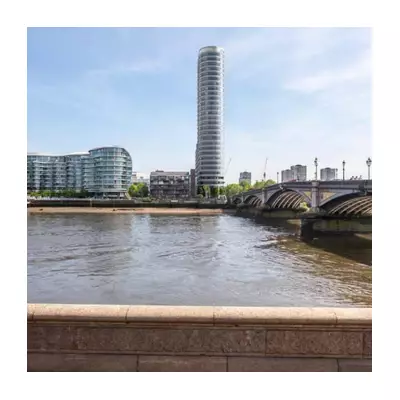

The pain is not evenly spread across the city. Certain boroughs are experiencing far higher rates of negative equity. Tower Hamlets recorded the highest figure in the country, with nearly 30 per cent of sellers making a loss. It was closely followed by the City of London (26.2 per cent), and the prestigious boroughs of Hammersmith and Fulham, Kensington and Chelsea, and Westminster, where over a fifth of sellers lost money. In contrast, London's most affordable borough, Barking and Dagenham, reported just 5.3 per cent of residents selling below their purchase price.

Aneisha Beveridge, Head of Research at Hamptons, commented on the trend: “In London, upward house price growth is no longer the one-way bet it once seemed. In some cases, even owners who bought a decade ago still face getting back less than they paid, something that would have been almost unthinkable in the heady days of 2015.”

Long-Term Owners and the North-South Divide

The overall average gain for a London seller in 2025 was £172,510 above the original purchase price, but this largely reflects historic growth. Over half of London sellers had owned their home for more than ten years, and these long-term owners accounted for 77 per cent of all gains made in the capital. The data also shows a clear divide between property types: house sellers were more than six times less likely to sell at a loss than flat sellers.

Nationally, the property market picture is changing. Sustained price growth in Northern regions over the past decade means sellers there now achieve proportionally higher gains than those in the South. In 2025, the average seller in the North West saw a 45.4 per cent increase in their home's value during ownership, surpassing both London (44.6 per cent) and the South East (38.3 per cent). London was the only southern region to break the 40 per cent gains threshold.

Beveridge warned of challenges ahead: “Over the next few years, more sellers are likely to have missed out on London’s 2012-16 house price boom, having bought instead at what turned out to be the top of the market. That could make trading up increasingly challenging... If the numbers don’t stack up, and sellers risk losing part of their original deposit, many choose to stay put.”

This dynamic risks locking some homeowners, particularly those in flats who cannot secure a gain, out of the moving market entirely, further constricting supply and activity in the capital's housing chain.