Wegovy Pill's Record-Breaking Launch Fuels $200bn Weight-Loss Market Expansion

The Wegovy daily pill has stormed onto the US market with an unprecedented launch, hailed by health analysts as "the fastest drug launch ever". In late January, it garnered 50,000 prescriptions weekly, outpacing the initial uptake of its injectable counterpart and rival jabs. This surge signals a pivotal shift in the anti-obesity sector, projected to balloon to $200bn by the end of the decade, as tablets promise to make weight-loss treatments more mainstream.

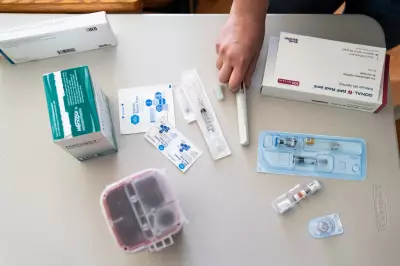

From Injections to Pills: A Personal and Market Transformation

Melody Ewert, a 44-year-old from Minnesota, exemplifies this transition. After losing 22.7kg on Eli Lilly's weekly Zepbound injection, she switched to Novo Nordisk's new daily Wegovy pill due to insurance changes that spiked her monthly cost from $25 to $449. "I just felt slow: I want to be able to do anything my kids want to do and not have weight be a factor," she shares, noting improved consistency in appetite suppression compared to the injection's fluctuations.

Dr. Eric Perakslis, chief science officer at Shotsy, observes "a flood of both" new patients and switchers to the pill, attracted by its simplicity. Patrick, a 33-year-old from New Jersey, pays $150 monthly out-of-pocket for the starter dose after regaining weight post-injection, hoping to replicate his prior 34kg loss.

Global Demand and Challenges in a Booming Sector

Pills offer advantages like needle aversion, lower costs, and no refrigeration needs, potentially broadening access. In the UK, the Wegovy pill is under regulatory review for a late 2024 launch, though NHS availability remains uncertain amid fears of counterfeit versions. Research from UCL reveals 1.6 million users in Great Britain from early 2024 to 2025, with nearly 10% of adults either using or interested in weight-loss drugs, despite affordability hurdles.

However, concerns persist over side-effects, supply chains, and pricing. The Wegovy pill costs $149-$299 monthly cash, less than injectables after recent price cuts. Novo Nordisk faces manufacturing scalability doubts for its high-concentration semaglutide tablet, contributing to a 17% stock drop in February after profit warnings.

Big Pharma's Race Intensifies with Pills and Injections

Novo's rival, Eli Lilly, plans an April US launch for its weight-loss pill orforglipron, a small molecule easier to absorb without fasting. Analysts at Goldman Sachs deem 2026 "pivotal" for the obesity market, with pills potentially expanding the addressable population. UBS forecasts peak annual sales of $3.25bn for the Wegovy pill versus $16bn for the injection, citing higher dropout rates due to side-effects like nausea.

Other players, including AstraZeneca and biotech firms, are developing new pills and injectables targeting hormones like amylin for enhanced regimens. Dr. Sophie Dix of MedExpress notes, "We haven't even scratched the surface yet in terms of the global eligible population," highlighting the sector's growth potential as prices drop and formulations diversify.

With Medicare set to cover GLP-1 drugs from April and global obesity rates rising, the shift from injections to pills is reshaping a market poised to redefine weight-loss treatment accessibility and efficacy.