UK and EU Scrutinize Supreme Court's Tariff Ruling as Businesses Exercise Caution

The United Kingdom and the European Union are actively evaluating the consequences of the US Supreme Court's landmark decision to overturn Donald Trump's global tariffs, with business organizations responding cautiously to the judicial announcement. A spokesperson from Downing Street emphasized that the UK government is engaged in discussions with American counterparts to comprehend how the ruling will impact British interests, while maintaining confidence that the nation's privileged trading status with the US will endure.

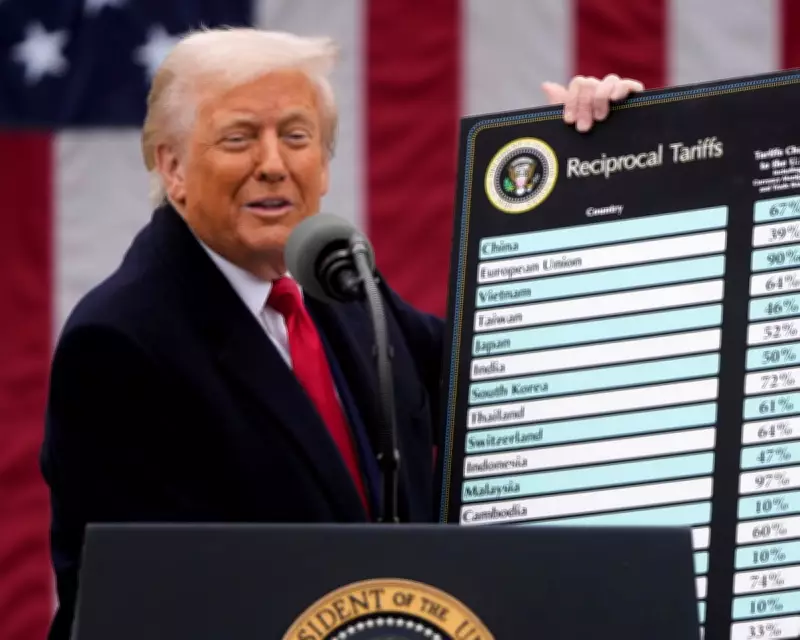

Historical Context and Current Tariff Structures

The UK pioneered a tariff agreement with the United States, securing a 10% levy on all imports from Britain, in contrast to the uniform 15% rate applied to the European Union. The Supreme Court determined that Trump unlawfully utilized executive authority to impose worldwide tariffs, prompting a reassessment of international trade dynamics. The EU has acknowledged it is analyzing the ruling while persisting in efforts to diminish the tariffs enforced on European exports by the US administration.

The European Union consented to the 15% tariff rate with the United States at Trump's Scottish golf course in July of the previous year, yet 50% tariffs remain on steel products. An EU statement clarified, "We remain in close contact with the US administration as we seek clarity on the steps they intend to take in response to this ruling." The statement further noted, "Businesses on both sides of the Atlantic depend on stability and predictability in the trading relationship. We therefore continue to advocate for low tariffs and to work towards reducing them."

Potential Refunds and Ongoing Tariff Challenges

Companies adversely affected by the tariffs may be entitled to request refunds from the US government, although the procedural framework for such claims remains ambiguous. It is understood that tariffs on specific commodities like steel will not be altered and are expected to stay in effect. Certain trade experts have cautioned that the White House might transition to more extensive product-based tariffs impacting sectors such as computer chips and agriculture, potentially adopting a more severe approach with elevated tariff rates.

John Denton, the secretary general of the International Chambers of Commerce, highlighted the "fresh uncertainty" confronting enterprises aiming to trade with the United States. Denton remarked, "Many businesses will welcome the prospect of refunds following today's ruling, given the significant strain that the IEEPA tariffs have placed on corporate balance sheets in recent months. But companies should not expect a simple process: the structure of US import procedures means claims are likely to be administratively complex."

Business Perspectives and Market Reactions

William Bain, the head of trade policy at the British Chambers of Commerce, observed that while the Supreme Court elucidated the use of executive powers to increase tariffs, it did "little to clear the murky waters for business." Bain warned, "If he wants to, Trump could use the 1974 Trade Act to impose even higher tariffs than the additional 10% levies that the UK and Australia have already been affected by in many goods sectors. We have recently agreed a good deal on pharmaceuticals, and we should focus on using the economic prosperity deal to ensure the UK gets the preferential treatment outlined there."

An insider from the aerospace industry expressed relief at the declaration but noted, "It's a relief that this has been declared, but I don't think it's that helpful for geopolitical tensions. We still have quite an unpredictable US administration, and I don't think taking this sort of public chastising is going to go well for some trade relationships."

Financial markets responded positively to the Supreme Court ruling, with the UK's FTSE 100 index achieving a new intraday peak on Friday and concluding 0.56% higher. Export-oriented companies experienced gains, including Diageo, which saw a 3.9% increase as its Scottish whisky and Mexican tequila brands had been impacted by Trump's tariffs, and Burberry, which advanced by 3.3%. European automakers like Stellantis, encompassing brands such as Citroën, Fiat, and Vauxhall, rose by 2%.

Conversely, US government bond prices declined, elevating borrowing costs as investors foresaw diminished tariff revenue and the potential for US companies to receive refunds on import expenses. The US dollar exhibited a slight depreciation in value.