The UK's premier stock market index, the FTSE 100, has achieved a historic milestone by smashing through the 10,000-point barrier for the very first time.

A New Year's Day Rally

The symbolic threshold was breached within just thirty minutes of trading commencing on Friday 2 January 2026. This landmark moment immediately marked 2026 as a standout year for the blue-chip index, which was first launched in 1984.

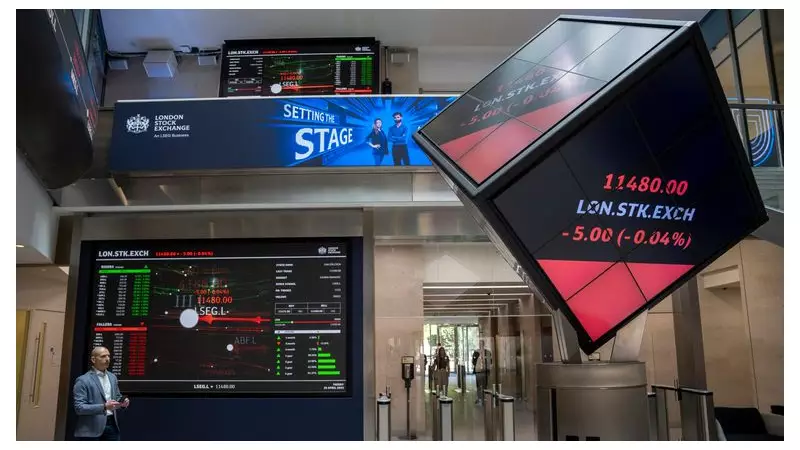

The Financial Times Stock Exchange 100 index tracks the share performance of the one hundred most valuable companies listed on the London Stock Exchange. Its roster includes major high-street lenders like Barclays, Natwest, HSBC, and Lloyds, alongside retail giants Tesco, Marks & Spencer, and Sainsbury's. A significant portion of the index is also comprised of international mining and oil and gas firms.

Policy Push Fuels Market Confidence

Market analysts were quick to link the surge to recent government announcements. Dan Coatsworth, head of markets at investment platform AJ Bell, described the breakthrough as "a historic moment" and "the best New Year's present Chancellor Rachel Reeves could want."

He pointed directly to the Chancellor's recent policy drive, stating: "She has been banging the drum about the merits of investing over parking cash in the bank, and the FTSE 100's achievements just go to show what's possible when buying UK shares." Key measures in the budget, such as the new £12,000 annual limit for tax-free cash ISAs, are explicitly designed to encourage savers to move money into the stock market.

Further reforms will also empower banks and building societies to offer financial advice to customers, potentially guiding more capital towards investments.

Stocks Leading the Charge

The opening day rally was powered by significant share price increases from leading companies. Notable gainers included aerospace engineering titan Rolls-Royce Holdings and precious metals miner Fresnillo, which helped propel the index to its unprecedented height.

This record-breaking performance provides a powerful early signal of investor confidence in the UK's economic landscape under the current government's financial strategy.