President Donald Trump is banking on major American oil corporations to execute his strategy for Venezuela, a plan centred on reviving the country's crippled petroleum industry to fund US ambitions there. However, significant obstacles from sanctions to ageing infrastructure could complicate this high-stakes venture.

The Presidential Proposal and Its Dependencies

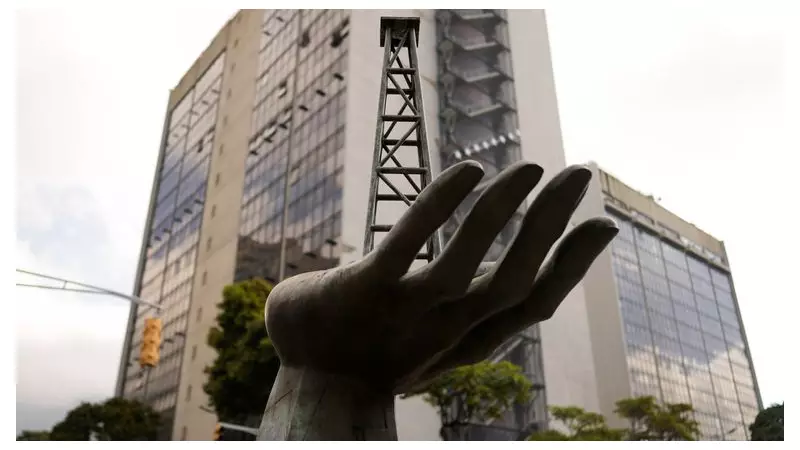

Following the capture of former leader Nicolas Maduro, President Trump outlined a vision where US oil firms would invest billions to repair Venezuela's dilapidated oil infrastructure. He asserted the US would be reimbursed for all costs through the substantial revenue generated. "We're going to have our very large United States oil companies, the biggest anywhere in the world, go in, spend billions of dollars... and start making money for the country," Trump stated at a press conference on Saturday 4 January 2026.

This plan places immense responsibility on the private sector. Currently, Chevron is the sole US multinational oil company operating in Venezuela. Two other giants, Exxon Mobil and ConocoPhillips, departed after the industry's nationalisation under the late Hugo Chávez and hold outstanding claims against the Venezuelan state. A meeting between representatives of these three firms and US Energy Secretary Chris Wright was reportedly scheduled for Thursday 9 January 2026.

Corporate Caution and Immediate Market Gains

Despite the potential of Venezuela's vast oil reserves, which are the largest globally yet contribute only 1% of world supply, the companies involved are publicly cautious. Chevron declined to comment on future investments, focusing instead on operational compliance and safety. ConocoPhillips similarly called it "premature to speculate on any future business activities."

Nevertheless, financial markets reacted positively to the geopolitical shift. Share prices for Chevron rose 5% on Monday 5 January 2026, with Exxon Mobil gaining over 2%. Oil refiners and service companies like Marathon Petroleum, Halliburton, and Valero Energy also saw significant boosts, ranging from 3.4% to 9.3%.

Substantial Challenges on the Ground

Several clear hurdles could derail or delay the plan. Venezuela remains under international sanctions, making exports subject to extra levies. The specifics of future oil regulation are unclear, and the status of a US-imposed quarantine on Venezuelan crude, initially enforced in December, is unknown.

Operational difficulties are also profound. Extracting Venezuela's viscous heavy crude is technically challenging, and modernising the country's ageing infrastructure will be costly and time-consuming. Furthermore, a key former buyer, China, is currently purchasing less oil due to the US quarantine and associated increased costs.

Finally, a core aim of Trump's policy—to push down global oil prices by increasing Venezuelan production—could ironically dampen the profit incentive for the very companies he needs to invest. With political uncertainty lingering despite the swearing-in of new premier Delcy Rodriguez, the road ahead for US oil giants in Venezuela is fraught with both great risk and potential reward.