The Australian Taxation Office has come under fire after revelations it paid a staggering £42 million to a single private debt collection agency, raising serious questions about the outsourcing of sensitive government functions.

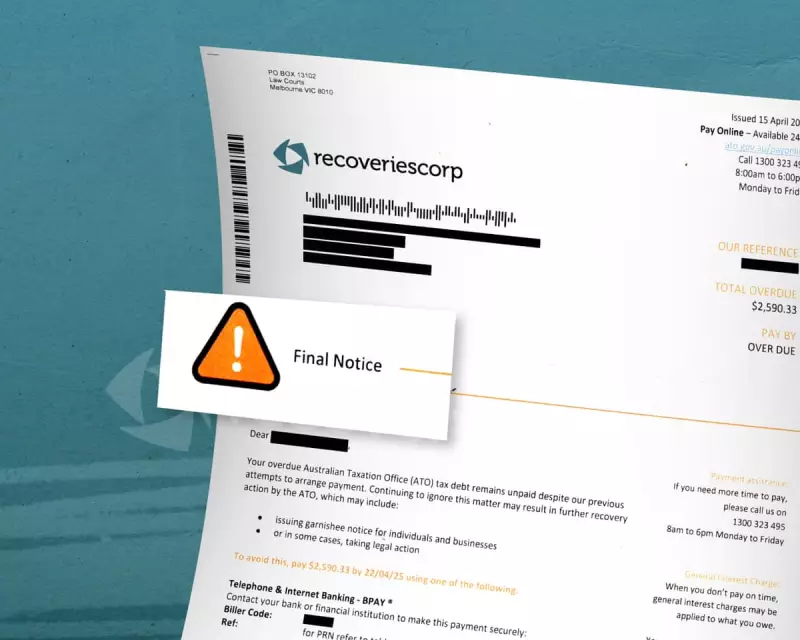

Newly released documents show RecoveriesCorp, a commercial debt recovery firm, received the massive payment over recent years to pursue outstanding tax debts on behalf of the ATO. The arrangement has sparked concern among financial experts and taxpayer advocates alike.

Public Money for Private Profit

Critics argue that paying millions to private contractors to collect public revenue represents a questionable use of taxpayer funds. "When a government agency pays substantial fees to private debt collectors, it essentially means public money is being used to generate private profit," explained one financial transparency advocate.

The substantial payment to RecoveriesCorp comes amid growing scrutiny of how government agencies manage debt recovery operations and whether such functions should remain in-house.

Questions Over Effectiveness and Ethics

Several key concerns have emerged about the ATO's approach:

- The cost-effectiveness of outsourcing versus internal collection efforts

- The potential for aggressive tactics by private collectors

- Transparency around performance metrics and success rates

- Protections for vulnerable taxpayers facing financial hardship

Taxpayer advocacy groups have called for greater scrutiny of such contracts, questioning whether the substantial fees paid to private firms represent value for money.

Broader Implications for Public Administration

This case highlights a wider trend of governments increasingly outsourcing core functions to private contractors. The ATO's multi-million pound arrangement with RecoveriesCorp serves as a stark example of how far this practice has extended into sensitive areas like tax collection.

As one policy analyst noted, "When debt collection becomes a profit-driven exercise rather than a service function, the potential for mission creep and questionable practices increases significantly."

The revelations have prompted calls for a comprehensive review of the ATO's debt recovery strategies and greater parliamentary oversight of such substantial outsourcing arrangements.