First Minister John Swinney has publicly pledged that the Scottish government will not increase income tax rates or introduce any new tax bands in its upcoming budget.

FMQs Clash Over Tax Policy

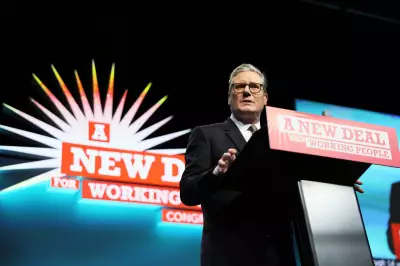

The significant announcement was made during a heated First Minister's Questions session at Holyrood on Thursday. Scottish Conservative leader Russell Findlay confronted the First Minister, accusing UK Chancellor Rachel Reeves of "screwing taxpayers" with her recent Budget, which included £26bn in tax rises and an extension of the threshold freeze.

Mr Findlay directly challenged Mr Swinney, asking if he would honour the SNP manifesto promise not to raise taxes on Scottish workers. He argued that Scottish taxpayers deserve a break and should be allowed to keep more of their own money.

Budget Strategy Confirmed

In his response, John Swinney stated that while the government is considering the implications of the UK budget, the core tax strategy for Scotland remains unchanged. He confirmed the position earlier articulated by Finance Secretary Shona Robison, who said the tax approach would be consistent ahead of next year's Scottish Parliament election.

"The finance secretary confirmed this morning that the Scottish government will not increase income tax rates or introduce any new bands," Mr Swinney told parliament. However, he notably did not disclose whether the existing income tax thresholds would be adjusted, leaving open the possibility of a fiscal drag effect where pay rises could push earners into higher bands.

Political Fallout and Funding Debate

The debate also touched upon the UK government's decision to scrap the two-child benefit cap, which has freed up approximately £155 million in Scottish government funds that were originally earmarked to mitigate the policy. Russell Findlay urged that this money should now be used to lower income tax bills for Scots.

Mr Swinney rejected this proposal, stating the funds would instead be invested in other initiatives to further reduce child poverty. He defended his government's position on higher earners paying more tax, stating "I'm prepared to do that so that I can work to eradicate child poverty, which is the best thing for the future of our country."

Scotland currently operates a more complex income tax system than the rest of the UK, with seven bands compared to the standard four, giving Holyrood ministers significant control over direct taxation for Scottish residents.